EVs might just work for Xiaomi.

- I have been pretty negative with regard to the prospects of Apple making and selling an electric vehicle due to the impact it would have on the company’s profitability.

- However, by the same token, the opposite may be true for Xiaomi which has always taken pride in its low hardware margins.

- Xiaomi, like everyone else it seems, is considering making an EV using Great Wall as the manufacturer and selling it under its own brand.

- Compared to some of the crazy ideas that I have heard over the last 6 months in this space, this one is not actually that crazy and may work quite well.

- This is for a number of reasons:

- First, profitability: There is no fundamental reason why Apple could not make an EV, but given its market position and brand, I think that this would be detrimental to its profitability and hence, valuation.

- Apple makes something like 50% margin on the iPhones it sells and there is no way that would be able to repeat this with vehicles.

- On the other hand, in Q4 2020, Xiaomi had gross margins of just 8.6% on its smartphones and I would estimate something like 3-4% at the operating level.

- This is broadly in line with automotive profitability and so there would be no real hit to its brand or margins if it chose to go down this route.

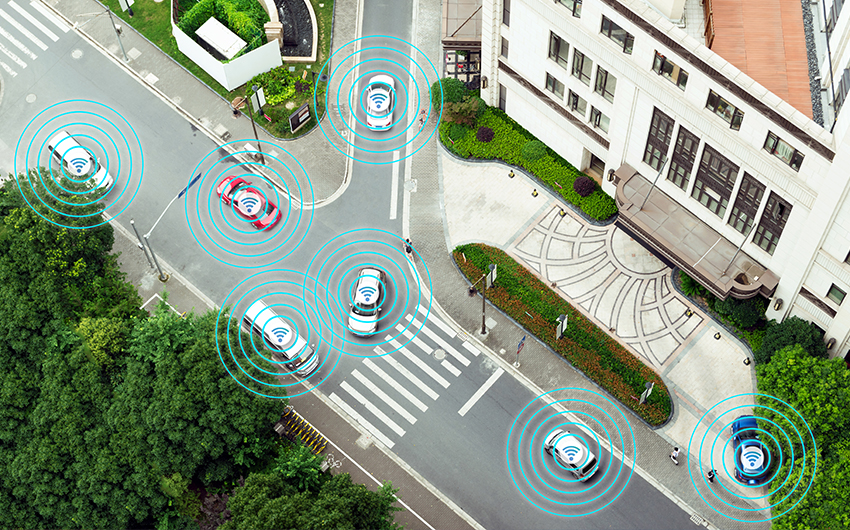

- Second, digital ecosystem. Xiaomi has built a large ecosystem of digital devices in China through a network of companies in whom it owns a minority stake.

- These companies contributed RMB1.4bn ($280m) to Xiaomi’s pre-tax profit in 2020 and between them represent a large network of devices that are broadly interoperable.

- This is something that none of the carmakers, not even Tesla have managed to achieve yet.

- Third, user experience: Xiaomi will be approaching this from the digital perspective rather than as a vehicle maker meaning that the digital experience will be the biggest selling point of this vehicle.

- This is something that is currently keeping Tesla way ahead of its competition and even the latest crop of EV upstarts have yet to really address this segment.

- Ford’s is making real progress with its Mustang Mach-E but Tesla is still the gold standard in the sector.

- Hence, there is an opportunity here for Xiaomi to close the gap on Tesla and also significant interoperability with the large number of smart home products that exist in its ecosystem.

- All of this assumes that Xiaomi is capable of making a decent vehicle which many are finding is much harder than it sounds even for EVs.

- Furthermore, its partner Great Wall is not exactly a titan of the automotive industry and has been trying and failing to make electric vehicles for some time.

- Hence, in order for this to work, I think that Xiaomi will have to hire some vehicle expertise on its side or find itself a more established partner.

- The vehicle is the next consumer device that is going to be digitised and I think that Xiaomi is reasonably positioned to have a credible go at this.

- I am still not a fan of Xiaomi’s valuation, but the fundamentals are improving and the valuation is slowly reaching a more reasonable level.

- A successful vehicle strategy could help it grow into a higher valuation.

- One to keep an eye on.