Battery life drives the earnings

- iPhone had a very good bounce off the lows of FQ1 19 driven by a recovery in China but a less than enthusiastic reception by the market and its valuation increase my inclination to take profits.

- FQ1 20 revenues / EPS were $91.82bn / $4.99 comfortably ahead of consensus at $88.41bn / $4.54.

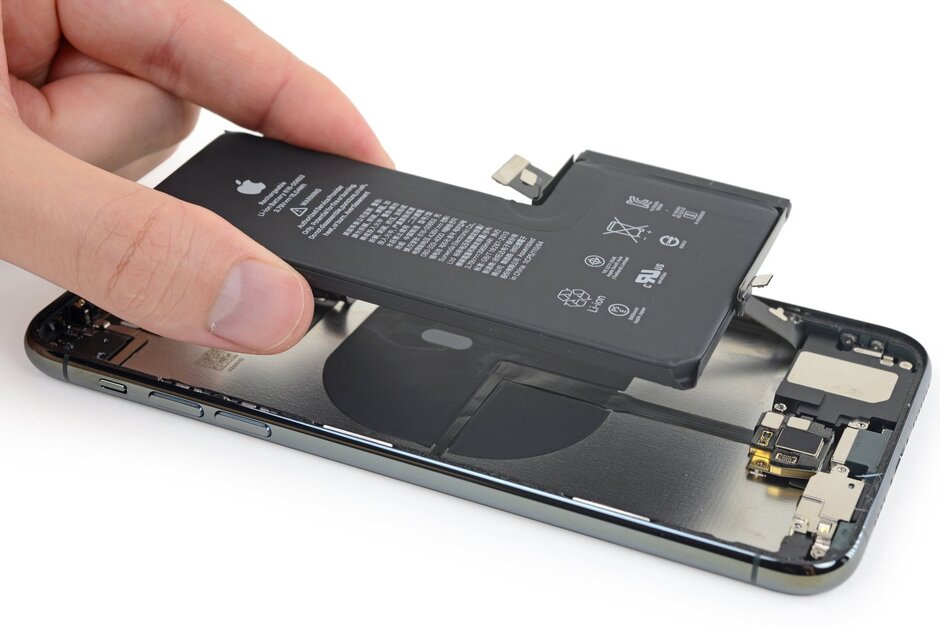

- The story of the night was obviously the iPhone which beat sales expectations by $4.58bn (8.9%) driven largely, I think, by the huge leap in battery life that the iPhone 11 affords which enticed users to make the upgrade.

- The new camera functionality is good but does not really distance itself much from the Android crowd, leaving battery life as the stand-out feature of the new device.

- Wearables also did well coming in slightly ahead of forecasts with revenues of $10.0bn ($9.9bn consensus) as Apple Watch and iPods continued to be extremely popular.

- It has taken a long time and I have been pretty sceptical, but Apple has finally gotten the watch to a place where it offers a level functionality that makes it more than a solution looking for a problem.

- This solution is predominantly wellness, and with sensor technology rapidly improving to be able to reliably measure other vital signs, the outlook remains pretty bright.

- Although services missed expectations slightly (perhaps due to Disney +), it grew strongly underlining competent execution of the current strategy.

- The iPhone has allowed Apple to build a large and engaged user base from which it is increasing its monetisation through the sale of peripherals and services.

- Hence, I think that the current iPhone strength will wane giving a steady outlook after a quarter or two leaving wearables and services to make all the running.

- This is a good strategy but these two are still too small to take over the mantle of high growth meaning that the real outlook will be slow and steady.

- There is nothing wrong with this, it is just a question of what the market is expecting and what the valuation demands.

- Apple’s PER ratio has increased substantially over the last few years meaning that it is no longer the cheap stock that it was.

- This makes it less resilient to market shocks and highlights that there are other companies on similar ratios that are exhibiting higher growth.

- It is here I would be looking for upside and still think that the timing is right to continue taking profits on Apple shares.

Blog Comments

Colin MacGregor

January 29, 2020 at 2:45 pm

RFM’s skepticism about Apple is beginning to look like a denial of reality. The success of the iPhone 11 family is not driven mainly by its battery capacity. Nor does Apple’s success depend upon Google’s failures, as in previous RFM “analysis”. Apple’s success depends upon many factors which RFM shows no sign of understanding.

RFM has been consistently negative about and hasn’t recommended AAPL for years. During 2019 the price has doubled and even the most ridiculous of the Apple naysayers seems to have recognised a “new reality” that Apple’s customers have known about for years.

It’s surprising that RFM is in a position to take profits on AAPL. Have you been following your own advice?

I look forward to the teenage jibes about fanboys.