The notion of a recovery is not as leftfield as I thought.

- Since the beginning of the pandemic, I have entertained the idea that automobile demand may be a late-stage beneficiary of the pandemic and now there are some signs of this.

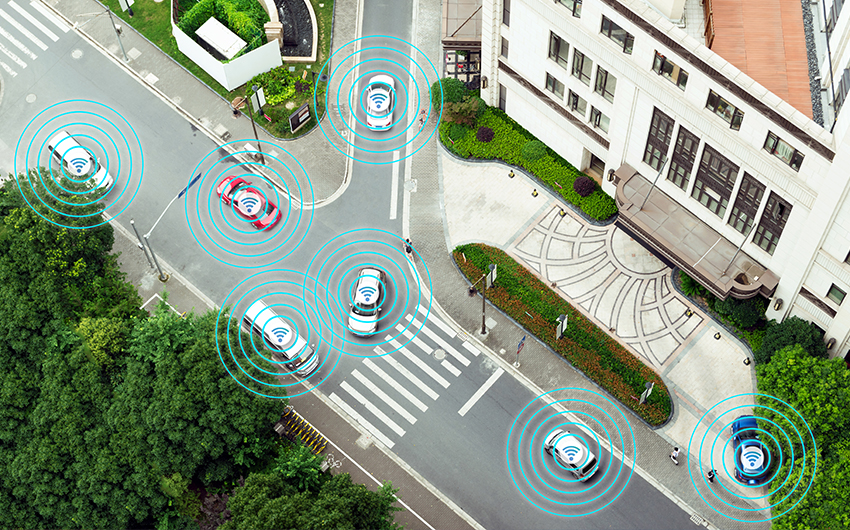

- The net result of this trend is likely to be a worsening of traffic (Beijing is already gridlocked once again) and a redoubling of efforts to get driverless cars onto the streets.

- As the traumatized public emerges from 2 months or more of lockdown, they appear to be far more likely to get into their cars than they are to take any other form of transport.

- There are two mains reasons for this.

- First: fear of infection: the lockdown and the prospect of wearing gloves and masks everywhere has traumatised and sensitised the population to the risk of infection.

- The net result of this is that asset sharing industries like ride-hailing and office sharing are going to continue to really suffer until there is a vaccine.

- To all practical purposes, I think that this means the end of 2021.

- The biggest asset sharing industry of all is public transportation and there are already anecdotal signs everywhere that this is being avoided in favour of private vehicles.

- In many cities in China, road congestion is already greater than it was in 2019 while the public metro systems are down 30% – 50% from 2019 (Bloomberg).

- At the same time, the UK government is urging those returning to work to use private vehicles, bicycles or walking rather than public transportation.

- Apple Maps data is also showing that requested driving directions are increasing in several North American cities while the use of mass transportation remains at very low levels.

- This makes complete sense as driving in a private vehicle is the perfect social distancing transportation system and I suspect that miles driven across the world are going to increase as will congestion.

- Second, aversion to flying. Getting on an aeroplane is already complicated enough with immigration and security and adding a whole new health-related layer to this will only degrade the experience even further.

- If one then also adds a 14-day mandatory quarantine at each end, almost every international trip becomes completely impractical.

- Furthermore, in order to maintain social distancing, aeroplanes may have to fly between 50% to 80% empty (depending on whose guidelines are adopted) meaning that just to stay flat on revenues, airlines have to increase fares by 2x – 4x.

- Hence, there is a high likelihood that demand for air travel will remain very depressed being replaced with staycations taken by vehicle where possible.

- Early data from China over the May Day holiday is an indicator of this trend which I suspect will be played out across the world.

- Hence, I suspect that miles driven by private vehicle across the world are going to see a meaningful uplift this year at the expense of public transportation and air travel.

- When a vaccine becomes available, this trend is likely to rapidly reverse, but I think this is unlikely within the next 18 months.

- More miles driven by vehicle is also likely to lead to an increase in the replacement rate meaning more new cars being sold.

- This is very much a necessity driven purchase and so I suspect that this lift will be felt in the mid and low end of the market rather than the luxury segment.

- Hence, it is Renault, Fiat, Nissan, VW, Toyota, Honda, Ford, GM etc that are likely to benefit the most with the likes of BMW, Mercedes and Audi largely missing out.

- The caveat to this is financing where financial institutions have become far more risk-averse meaning that the availability of credit has dropped sharply.

- At the same time, there are strong indications that consumer spending has fallen sharply with the focus moving onto essentials, saving and paying down debt.

- This is far from an ideal environment for vehicle purchasing and so this trend really depends on how essential those vehicle miles are perceived to have become.

- There is no tangible sign of this yet, but it could provide a badly needed lift for vehicle makers, some of whom may be flirting with bankruptcy once again.

Blog Comments

Sudhakar

May 12, 2020 at 7:04 pm

Does this analysis also take into consideration the huge growth in remote working across the world, which will also create downward pressure on new car purchases